Only One in Four High-Risk Rural Births Get Appropriate Hospital Care

A Multi-State Study Finds That Parents Often Travel 60+ Miles—With Distance, Insurance, and Race Driving Gaps in Maternal Care

In Their Own Words

The following excerpt is from an op-ed originally published in the Philadelphia Inquirer on October 27, 2025.

Last week, City Council held a hearing on the future of the city’s sweetened beverage tax, with some members suggesting it should be reversed. As health policy researchers at the University of Pennsylvania, we have studied this tax since its 2017 debut. The data on its effects are clear: The tax improves residents’ health while generating game-changing revenue for schools, libraries, and construction jobs.

Repealing the tax would be a grave mistake that would harm Philadelphia’s children and put a wrecking ball to a host of rebuilding efforts that have helped transform city neighborhoods.

Philadelphia is the largest city in the nation with a sweetened beverage tax. We place a 1.5 cents-per-ounce tax on sweetened drinks, leading to an average price increase of about 30%. We’ve had the levy for more than seven years, and it has funded the city’s largest public works program in recent history.

Councilmember Jim Harrity has argued that Philadelphia should consider repealing the tax based on claims not well supported by evidence. Harrity asserts that the tax hurts businesses because Philadelphians are buying less soda and other sugary drinks and shopping for groceries in nearby counties without a tax, causing soda companies to lay off workers and supermarkets to close.

Read the full op-ed here.

A Multi-State Study Finds That Parents Often Travel 60+ Miles—With Distance, Insurance, and Race Driving Gaps in Maternal Care

Former CMMI Leader Liz Fowler Cites Rigid Federal Scoring Rules and Bureaucratic Impatience for Pilot Failures

A Major European–U.S. Hospital Study Finds That Changing How Hospitals Are Organized Reduces Burnout and Turnover While Improving Care Quality

An LDI Fellow Who Helped Architect the ACA Highlights Progress on Primary Care Payment Reform and the Expansion of Site-Neutral Reimbursement Policies

Penn LDI Senior Fellow Dominic Sisti Cites “Alarming Levels”

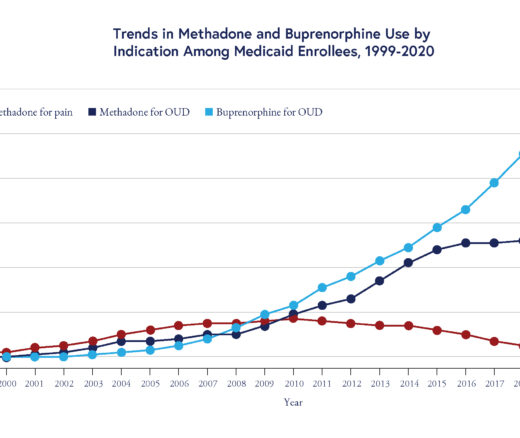

Chart of the Day: Methadone Use for Opioid Use Disorder Tripled From 2010–2020, Yet Only One in Four People With Addiction Receive Medication