Medicare’s Hidden Fix for High Drug Costs

Medicare’s Payment Plan Can Ease Seniors’ Crushing Drug Costs but Medicare Buries it in the Fine Print

Blog Post

Supplemental benefits covering dental, vision, and other care are an attractive feature of Medicare Advantage managed care plans. These benefits cost $64 billion annually and have been expanded to include home care, food assistance, and more. Some coverage overlaps with Medicaid benefits, creating a confusing situation for people who are eligible for both Medicare and Medicaid, called “dual eligibles.”

In two commentaries, LDI Senior Fellow Eric T. Roberts and colleagues suggest supplemental benefit reforms, including for dually eligible individuals enrolled in Dual Eligible Special Needs Plans (D-SNPs), which are Medicare Advantage plans that are supposed to coordinate Medicare and Medicaid coverage. “We all agree that covering hearing aids, dental care, and help with meals and daily activities is worthwhile,” said Roberts, “but coverage is increasingly complicated by the growing array of benefits in D-SNPs that are hard to coordinate with Medicaid.”

More than 9 million people are dually eligible for Medicare and full Medicaid, including Medicaid benefits like long-term care, and in most states, dental and vision care. However, dually eligible individuals do not receive double the coverage or care because Medicare and Medicaid operate separately, so responsibility and accountability for dual eligibles are often unclear.

In an LDI conference, Roberts said, “Dual eligibles account for about one-sixth of the Medicare population and one-seventh of the Medicaid population, yet they’re over 30% of the spending in both programs.” He also noted, “Dually eligible individuals often do not receive high-quality, efficient, or equitable care.”

Only about 10% of dually eligible individuals receive Medicare and Medicaid through fully integrated plans that manage benefits and spending across both programs. The rest have largely uncoordinated coverage, with separate Medicare and Medicaid insurance cards and coverage rules that are not harmonized.

Further, Medicaid is considered a “payer of last resort,” responsible for services not covered by other insurers, including Medicare. Dual eligibles are expected to figure out whether a service is covered by Medicare before determining if Medicaid will cover the remaining costs. Many dual eligibles navigate this system with little support—often while dealing with chronic illnesses and burdens such as food, transportation, and housing insecurity.

Medicare Advantage D-SNP plans have grown from 1.5 million enrollees in 2014 to 6 million in 2024. The number of D-SNPs has proliferated, in part because they are profitable for insurers under Medicare Advantage’s payment model that pays more for higher-risk patients. Although D-SNPs are supposed to coordinate services with Medicaid, most D-SNPs are not fully integrated with Medicaid, meaning that their enrollees still primarily receive Medicare and Medicaid through separate programs.

The supplemental benefits offered by D-SNPs are popular with enrollees, but create a conundrum when they overlap with Medicaid coverage. In their JAMA Health Forum commentary, Roberts and colleagues outline challenges dual eligibles face in accessing supplemental benefits in D-SNPs.

Overlapping benefits. Currently, Medicaid programs in 43 states offer some dental coverage for adults, and D-SNPs may also include dental coverage. The lack of integrated coverage for most dual eligibles places the burden on individuals to navigate how to use Medicare and Medicaid dental benefits that have different coverage rules, limitations, and provider networks.

Roberts and colleagues also use the example of in-home and adult day services that can be a Medicare Advantage supplemental benefit. Although similar to Medicaid’s long-term services and supports, under Medicare Advantage, these benefits are usually time limited, appropriate for short-term home care after hospitalization. Under Medicaid, these services are not time limited and better for longer-term assistance. However, D-SNP efforts to optimize beneficiaries’ use of home care benefits across Medicare and Medicaid are unclear.

Lack of benefits transparency. The profitability of D-SNP plans has led to aggressive marketing of supplemental benefits, such as food assistance, in order to attract enrollees. However, eligibility restrictions and coverage limits are often disclosed only in fine print. When choosing among plans, enrollees may not know of these limitations.

Inadequate tracking. Lack of Medicare-Medicaid cross-plan coordination is also a problem for the Centers for Medicare and Medicaid Services (CMS). CMS pays Medicare Advantage insurers, including for D-SNPs, to cover enrollees’ benefits and need detailed information about their care and costs to ensure effective use of funds. Although plans must report supplemental benefit use at the member level, a recent federal audit found unreliable reporting by plans, hindering monitoring of how supplemental benefit dollars are used.

1. Improve Medicare-Medicare coordination within D-SNPs. Beneficiaries should not have to decide which coverage to use in a health care situation. Instead, Roberts suggests that state Medicaid agencies leverage their D-SNP contracts with insurers to require them to coordinate Medicare and Medicaid coverage to optimize the use of their enrollees’ benefits.

2. Be transparent about benefits. The Medicare Advantage plan finder does not show dual eligibles their potential Medicaid benefits. This information should be available, presented to allow easy plan comparison, with navigation assistance to help dually eligible individuals make informed benefit choices.

3. Monitor enrollees’ receipt of benefits. This will help CMS and researchers follow the money, to keep insurers accountable and ensure taxpayers get a return on the D-SNP investment as better beneficiary health and reduced costs.

Progress on these reforms is underway, Roberts said. In 2025, CMS will begin notifying Medicare Advantage beneficiaries annually about unused supplemental benefits they qualify for and how to access them. Other changes include simplifying plan decisions by limiting the number of D-SNPs an insurer can offer, expanding enrollment periods beyond once per year, and encouraging enrollment in D-SNPs with the highest level of Medicare-Medicaid integration.

The study,“Medicare Advantage Supplemental Benefits for Dual-Eligible Beneficiaries and Recommendations for Reform,” was published on September 6, 2024 in JAMA Health Forum. Authors include Eric T. Roberts, Eliza Macneal, and John Lovelace.

The study, “Medicare Advantage Supplemental Benefits: Origins, Evolution, and Issues For Policy Making,” published on September 19, 2024 in Health Affairs Forefront. Authors include Eric T. Roberts, Robert Burke, and Kathleen Haddad.

Medicare’s Payment Plan Can Ease Seniors’ Crushing Drug Costs but Medicare Buries it in the Fine Print

Even With Lower Prices, Medicare, Medicaid, and Other Insurers Tighten Coverage for Drugs Like Mounjaro and Zepbound Using Prior Authorization and Other Tools

Pandemic-Era Medicare Flexibilities Have Proven Effective, Popular, and Safe

A 2024 Study Showing How Even Small Copays Reduce PrEP Use Fueled Media, Legal, and Advocacy Efforts As Courts Weighed a Case Threatening No-Cost Preventive Care for Millions

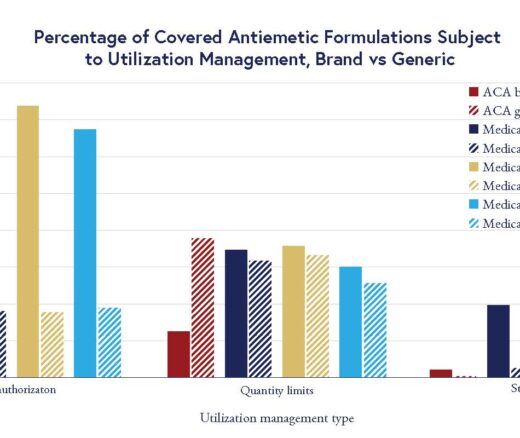

Chart of the Day: LDI Researchers Report Major Coverage Differences Across ACA and Medicaid Plans, Affecting Access to Drugs That Treat Chemo-Related Nausea

Insurers Avoid Counties With Small Populations and Poor Health but a New LDI Study Finds Limited Evidence of Anticompetitive Behavior