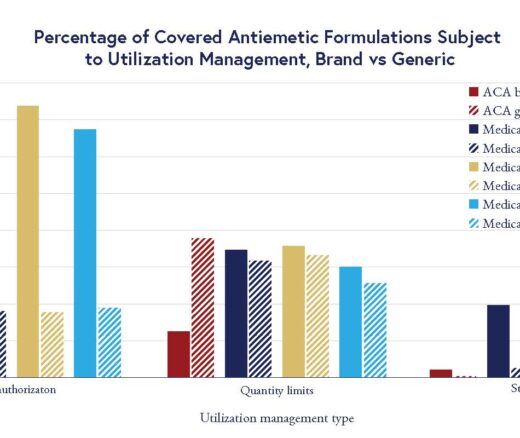

Insurers’ Utilization Management Tools Vary Widely on Anti-Nausea Drugs for Cancer

Chart of the Day: LDI Researchers Report Major Coverage Differences Across ACA and Medicaid Plans, Affecting Access to Drugs That Treat Chemo-Related Nausea

Blog Post

Starting this year, all Medicare beneficiaries with Part D drug coverage have a $2,000 annual cap on their out-of-pocket medication costs. The cap, part of the 2022 Inflation Reduction Act, is meant to protect Medicare recipients who are not eligible for low-income subsidies from high drug costs.

“We were surprised to find that many Medicare beneficiaries who have high total drug spending do not have high enough out-of-pocket expenditures to reach the cap,” said LDI Senior Fellow Alexander Olssen. That result was the main takeaway from a new study by Olssen, LDI Research Assistant Debra Lederman, and LDI Senior Fellow Mark Pauly.

To see how the drug spending cap would affect Medicare beneficiaries predicted to have high out-of-pocket costs, the researchers did two analyses using 2022 data for traditional Medicare and Medicare Advantage enrollees. Using 5% samples of the data for each analysis, they calculated the impact of the spending cap on individuals whose total 2022 drug spending exceeded $6,560. This amount would have resulted in out-of-pocket costs that would be reduced by the $2,000 cap for people on a Part D plan with the standard benefit. They also examined the impact on Medicare beneficiaries in the top 1% of total drug spending.

Average out-of-pocket spending for the sample of beneficiaries with drug costs over $6,560 ranged from under $500 to more than $3,700 across quartiles of total spending. Overall, however, 65% of these individuals did not have out-of-pocket costs greater than $2,000, so they would not qualify for the spending cap if their costs in 2025 matched those in 2022.

Beneficiaries in the sample with total drug spending in the top 1% all had medication costs in 2022 that exceeded $45,000. Their average out-of-pocket cost was around $5,300. Nonetheless, 38% did not have out-of-pocket expenses greater than the $2,000 cap.

Retiree group plans and other non-Medicare coverage may be one reason many Medicare beneficiaries with high annual medication costs may not have high out-of-pocket costs, Olssen said. This additional insurance may be offered through work connections, so many current or former government or academic employees or union members have it. This coverage can reduce or eliminate deductibles and other patient drug costs. The study showed that, in fact, 42% of the group with the highest total drug costs had additional coverage.

“The study results do not necessarily indicate a problem with the drug spending cap,” Olssen said. “The cap will help beneficiaries who have very high out-of-pocket costs.” However, the results suggest that many Medicare beneficiaries might not benefit from the cap, even those using expensive drugs.

The researchers also note that the cap could change beneficiaries’ plan purchasing behavior if they decide the $2,000 drug spending cap is sufficient coverage and drop their retiree group plans in favor of Part D plans. This could shift more costs onto Medicare. The research team is currently studying the potential impact of a related part of the Inflation Reduction Act: Medicare’s drug price negotiations.

The study, “Substantial Variation Among Medicare Beneficiaries in the Impact From 2025 Part D Out Of Pocket Spending Caps,” was published in April 2025 in Health Affairs Scholar. Authors include Debra M. Lederman, Alexander L. Olssen, and Mark V. Pauly.

Chart of the Day: LDI Researchers Report Major Coverage Differences Across ACA and Medicaid Plans, Affecting Access to Drugs That Treat Chemo-Related Nausea

Insurers Avoid Counties With Small Populations and Poor Health but a New LDI Study Finds Limited Evidence of Anticompetitive Behavior

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

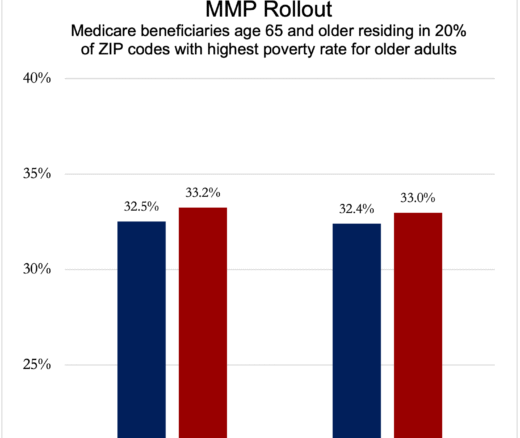

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Research Brief: Shorter Stays in Skilled Nursing Facilities and Less Home Health Didn’t Lead to Worse Outcomes, Pointing to Opportunities for Traditional Medicare

How Threatened Reproductive Rights Pushed More Pennsylvanians Toward Sterilization