Acupuncture Could Fix America’s Chronic Pain Crisis–So Why Can’t Patients Get It?

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

In Their Own Words

Cross-posted with permission from Health Affairs Forefront.

[Original Post: Jalpa Doshi, Amy Niles, Smoothing Medicare Part D Out-Of-Pocket Costs Under The Inflation Reduction Act, Health Affairs Forefront, February 3, 2023, https://www.healthaffairs.org/content/forefront/smoothing-part-d-out-pocket-costs-under-inflation-reduction-act, Copyright © 2023 Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.]

The Inflation Reduction Act (IRA) of 2022 marks the first major overhaul of the Medicare Part D prescription drug benefit in over a decade. Media coverage has largely focused on one Medicare reform enacted through the IRA—a $2,000 limit on annual Part D out-of-pocket prescription costs starting in 2025. However, an equally important provision in the legislation has been overlooked: giving beneficiaries the option of “smoothing” their Part D out-of-pocket costs starting in 2025. In contrast to the current Part D benefit structure where out-of-pocket costs are typically frontloaded at the start of each calendar year, the “smoothing” option will allow Medicare beneficiaries to spread their out-of-pocket prescription costs more evenly with monthly installments. Smoothing has the potential to be transformative for patients with high out-of-pocket drug costs, but its success will depend on how the Centers for Medicare and Medicaid Services (CMS) and other stakeholders design, promote, and implement the program.

Since the implementation of Medicare Part D in 2006, a growing number of beneficiaries have faced insurmountable out-of-pocket costs for their medications. This is particularly true for patients requiring high-cost specialty drugs. High cost sharing (25%-33% coinsurance) until a catastrophic spending threshold is reached after which patients pay 5% coinsurance for the remainder of the year (i.e. no annual cap) results in prohibitive out-of-pocket costs, especially early in the year. Research has shown that patient out-of-pocket costs under Part D are “too much and (occurred) too soon” in the calendar year and are associated with high rates of prescription abandonment, reductions and delays in treatment initiation; treatment interruptions; and earlier discontinuation of specialty drug treatments.

In 2017, Doshi and colleagues proposed a policy solution (later discussed in a 2018 Health Affairs Forefront article) to address this problem: an annual Part D out-of-pocket cap, plus monthly caps to distribute these costs more evenly throughout the year, also known as “smoothing.” The benefits of a combined annual cap and smoothing were further illustrated in a case study describing John Doe, a 73-year-old man living with chronic myeloid leukemia, a form of blood cancer. John was prescribed a life-saving anticancer medication with an annual list price of approximately $167,000. His annual income was above the qualifying threshold for the Medicare Part D Low-Income Subsidy program.

Without a Part D cap and smoothing, John would have been responsible for $10,602 in total out-of-pocket costs during the year for just this one specialty medication. More importantly, John would have owed approximately $3,000 for his anticancer prescription in January alone to reach the catastrophic phase of coverage, followed by estimated monthly payments of $700 per month (i.e. 5% coinsurance on the list price of his prescription) until end of the year. With a $2,000 annual Part D cap in place, John would owe the entire $2,000 in out-of-pocket costs for his anticancer prescription in January, with no additional payments required for the rest of the year. With a $2,000 annual Part D cap and smoothing in place, John would be able to spread out his $2,000 out-of-pocket responsibility over 12 months, paying $167 per month.

While an annual cap significantly reduced John’s total annual out-of-pocket responsibility, without the smoothing option, he still faced a substantial financial burden early in the year. Scraping together a “lump sum” amount of $2,000 is challenging for John and for many people on Medicare and substantially increases their likelihood of abandoning their anticancer prescription. According to recent national polling, about 75% of seniors enrolled in Medicare say that they cannot afford to pay more than $200 out of pocket for their prescriptions each month.

In addition to the annual cap, Medicare beneficiaries will have the option of “smoothing” their Part D out-of-pocket costs starting January 1, 2025. Under the law, each Part D plan sponsor shall provide to any plan enrollee the option to elect to pay their cost-sharing in monthly amounts that are capped based on a maximum monthly cap determined for each month they are enrolled in the smoothing program.

For the first month for which the beneficiary has made an election to “smooth” costs, the maximum monthly cap will be an amount determined by calculating the annual out-of-pocket maximum (i.e. $2000), minus the out-of-pocket costs incurred by the beneficiary to date, divided by the number of months remaining in the plan year. For subsequent months, the maximum monthly cap would be determined by calculating the sum of any remaining out-of-pocket costs owed by the beneficiary from a previous month that have not yet been billed to the beneficiary and any additional out-of-pocket costs incurred by the beneficiary divided by the number of months remaining in the plan year. Beneficiaries can voluntarily enroll in the smoothing program prior to the beginning of the plan year or in any month during the plan year.

Because smoothing is set up as a voluntary program and beneficiaries must reenroll each year, it is critical that its availability and benefits are clearly conveyed, especially to patients with high prescription drug costs. The law currently requires Part D plan sponsors to notify prospective enrollees of this option via promotional and educational materials. The law also requires CMS to develop educational materials and notices to make Part D enrollees aware of this smoothing option. Additional outreach and education efforts will be critical to ensure that beneficiaries most in need of smoothing do not fall through the cracks. The patient advocacy community is an ideal partner, and CMS should engage these organizations to ensure that patients living with life-threatening, chronic, and rare diseases who have been prescribed specialty medications are aware of the smoothing program’s existence. Clinical societies should also be encouraged to educate specialists, who are prescribing high-cost Part D medications to Medicare beneficiaries. Healthcare providers are trusted sources of information for patients and are uniquely positioned to inform patients at the time of prescribing about smoothing.

It is also critical that CMS collaborate with the pharmacy community to educate them about smoothing, since the law requires plan sponsors to notify pharmacies when patients incur out-of-pocket costs that make it likely they will benefit from opting into the smoothing program. Once notified, pharmacists and pharmacy staff can then educate patients about smoothing. Charitable foundations that support Medicare beneficiaries, organizations that focus on older adults and individuals with disabilities, disease-specific organizations, and state health insurance assistance programs should also serve as partners to CMS in developing an outreach and education plan.

In the future, policymakers could consider setting the smoothing provision as a default option (and allowing beneficiaries to “opt out” if desired) rather than the current requirement to opt-in. Behavioral economics research has shown that automatic enrollment increases participation rates in employer-sponsored retirement plans, especially for those with low incomes. Further, once a beneficiary has elected to enroll in the program, they should not have to reapply each year.

Currently, a significant flaw in the smoothing provision is the lack of patient protections. The law states that if a beneficiary fails to pay the amount billed for a month, the beneficiary will be terminated from the smoothing program for the remainder of the plan year and will be asked to pay the balance of the cost-sharing owed up to the Part D cap. The plan may also preclude the beneficiary’s participation in smoothing in a subsequent plan year.

We believe the current language is too unforgiving and does not consider real-life circumstances that prevent patients from dealing with financial matters in the short term, such as a sudden medical event, hospitalization, or chemotherapy treatment.

We recommend that CMS set forth clear requirements for plans to establish standardized protections for beneficiaries. For example, CMS should require Part D plans to have a minimum grace period for late payments and a process to remediate payment issues with beneficiaries before disenrolling them from the smoothing program. Beneficiaries should have a standardized process to appeal dismissal from the program by their plan sponsors. Educational outreach should alert beneficiaries about how to stay in good standing, what to do if payments are late or missed, and how to track their monthly payments. As part of the implementation, CMS should also consider permitting automated payment options to help patients avoid accidentally missing payments.

The timing of when a beneficiary joins the smoothing program can greatly impact the calculation of the monthly amount owed. For instance, a beneficiary who is a longstanding specialty medication user will likely opt-in to smoothing in January. Assuming John Doe from above enrolls in January, his monthly out-of-pocket cost would be $2,000 divided by 12 months, or $167 per month. But what happens if a patient is newly diagnosed in the middle of the year with a condition that requires specialty drug treatment? Or what if a patient should require a mid-year switch from a less expensive, traditional chemotherapy under Part B to a more expensive novel anticancer medication under Part D? As explained earlier, the monthly out-of-pocket amount calculation under the law is a function of the remaining months in the calendar year (and the patient’s out-of-pocket spending during the year so far). Later initiation of an expensive treatment can lead to steep monthly payments. For example, if John Doe was diagnosed/prescribed at the beginning of September, his monthly smoothing payments would be $500, assuming he had no prior out-of-pocket expenses in the year.

In such instances, beneficiaries are potentially at higher risk for either delaying needed treatment until the beginning of the next calendar year or for being penalized for failing to make monthly payments. In the short term, such beneficiaries, especially those with limited means, will likely need charitable assistance to serve as a financial bridge until the next January when they can enroll in the smoothing program and spread their out-of-pocket costs over 12 monthly installments.

In the future, policymakers could consider alleviating much of this uncertainty and variability by predefining the maximum monthly cap for each year by dividing the annual Part D cap by 12 months (i.e. $167 per month for a $2,000 annual cap) for all beneficiaries. This would allow for better predictability and consistency in out-of-pocket costs for all Medicare beneficiaries. It would also greatly simplify the implementation of the smoothing program for Part D plan sponsors and pharmacies.

The IRA currently places much of the responsibility for implementing and managing the smoothing program on Part D plan sponsors. Given the number of Part D plan choices beneficiaries face during annual enrollment and the fact that few beneficiaries switch plans from year-to-year, it is important for CMS to set forth standardized criteria for all plan responsibilities related to the smoothing provision. This will minimize potential confusion and ensure all beneficiaries benefit similarly from the smoothing program, regardless of their plan choice. CMS should consider developing and asking plans to use standardized language when describing the smoothing program in plan materials. Similarly, standardized criteria regarding patient protections must be developed.

The IRA has placed greater financial liability for Part D drug costs on plan sponsors (from 15% to 60% of drug costs in the catastrophic coverage phase). We recognize that specialty drug users enrolled in the smoothing program are less likely to abandon their prescriptions and more likely to reach the catastrophic coverage phase as the monthly payments are more manageable. For such patients, the plans will have increased financial liability for the remainder of the year. Despite the increased financial burden plans will face, we must ensure that they are doing all they can to educate and promote the ability for patients to opt-in for smoothing, and that protections are in place to ensure patients stay enrolled. We recommend that CMS have strong oversight of smoothing implementation by plan sponsors.

In the future, CMS should consider incorporating smoothing-related metrics into the Medicare Part D Star ratings program as a way to assess plans’ success in implementing the smoothing provision. Research has shown that Part D Star ratings and associated quality bonus payments, correlate with better patient experiences and increased delivery of services captured in the Star ratings metrics.

The implementation of a $2,000 annual Part D cap in 2025 will lower out-of-pocket costs for many. However, this provision alone will not alleviate the high financial burden faced by Medicare beneficiaries early in the year, nor will it reduce their likelihood of abandoning needed high-cost medications. Careful implementation of the smoothing provision is necessary in order to achieve policymakers’ goals of making prescription medications more affordable and improving medication adherence for our nation’s seniors and those with disabilities. This is especially important given the increasing trends in both the number of high-cost specialty medications becoming available and the more common disease conditions they treat.

Careful implementation of the smoothing program will avoid exacerbation of health disparities. Wide disparities in the income and assets of people on Medicare by race and ethnicity have been documented. The median per capita income in 2016 of White Medicare beneficiaries was $30,050, nearly double that of Black beneficiaries ($17,350) and more than double that of Hispanic beneficiaries ($13,650). Given that racial/ethnic minority patients already have lower incomes (and therefore less ability to afford Part D cost-sharing and potentially higher rates of prescription abandonment), lower enrollment in the smoothing program among these subgroups may result in these beneficiaries not reaping the full benefits and thereby exacerbating disparities. In addition, if these subgroups are also at higher risk of missing a monthly payment and being disenrolled from the smoothing program then that too will exacerbate disparities. Well-planned outreach and education ensuring high enrollment rates and adequate patient protection measures within the smoothing program will be critical to achieving the Medicare program’s health equity goals.

In the year ahead, CMS and all stakeholder groups must collaborate to put patients first as they create implementation guidance for the smoothing provision. We cannot afford any delays or hurdles in the needed relief that smoothing out-of-pocket costs will offer. Medicare beneficiaries living with high-cost chronic illnesses and limited means have waited long enough navigating the bumpy road of the Part D benefit structure. They deserve a smooth ride with one of the most important Medicare reforms passed as part of the Inflation Reduction Act.

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

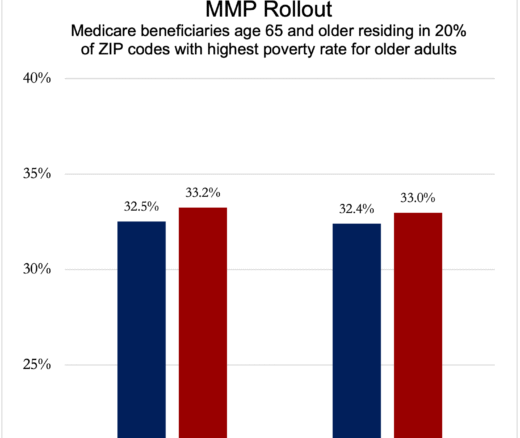

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Research Brief: Shorter Stays in Skilled Nursing Facilities and Less Home Health Didn’t Lead to Worse Outcomes, Pointing to Opportunities for Traditional Medicare

How Threatened Reproductive Rights Pushed More Pennsylvanians Toward Sterilization

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

They Reduce Coverage, Not Costs, History Shows. Smarter Incentives Would Encourage the Private Sector