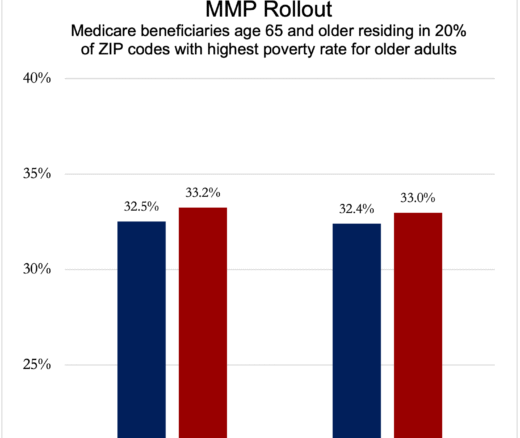

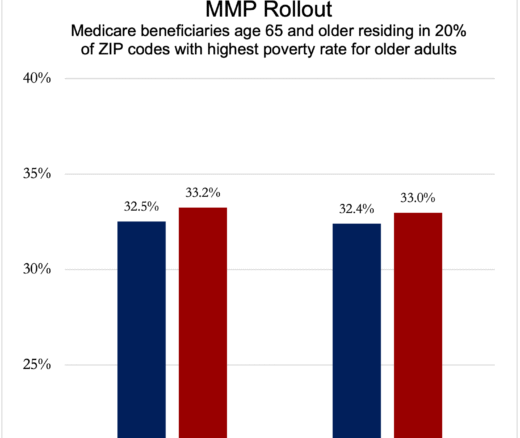

Integrated Care Plans Didn’t Boost Medicaid Enrollment for the Poorest Seniors

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

In Their Own Words

One of the core tenets of economic analysis of competitive markets is that, in competitive equilibrium, a particular good or service produced by multiple competing firms should sell for the same price. This “Law of One Price” follows from the assumed property in a competitive market with informed buyers and no other distortions that buyers will choose the lowest-priced seller. Hence any seller charging a price different from the lowest will have no customers and no sales. Paradoxically, if a market has a single pure monopolist the Law of One Price will also hold, since the monopolist’s price is the only price in the market.

However, this simple story starts to break down in other possible settings which may characterize medical services. Here is one reason: If patients make the choice about which producer, among several, to use but are not well-informed about different prices charged by different sellers of the same service of the same quality, and/or if they do not pay the total price charged because of insurance, some of them may choose to buy from a seller who has not set the lowest price. The existence of a (price) search cost can lead to a setting in which different sellers pursuing profits set different prices, and in which some consumers pay higher prices than others. There is an upper limit on the price a seller charges—it cannot be so high that buyers are worse off buying the overpriced product—but it can vary across firms with the same cost of production. With search costs to buyers and fixed costs to sellers, there can still be a market equilibrium in which all sellers earn the same profit. Some charge high prices and sell little, while others charge low prices and sell more—but do not sell to the entire market. If the search cost could be eliminated or offset, prices would fall to cost at efficient firm size scale while the number of firms would shrink.

Spending would then be lower. This possibility has led to policies enacted by Congress to compel “price transparency” by providers of Part B drugs, meaning the full disclosure of a single (list) price for each service the firm supplies and for the bundle of drug material and administration. If some buyers have insurance with deductibles and are paying the full price charged by any firm, such a law should lead those buyers to change their provider choice behavior (for “shoppable” medical services) in ways that reduce spending. If the patient is paying 20% with coinsurance, there is still an incentive, even if a weaker one, to choose the lower-priced seller since 20% of a low price is less than 20% of a high price. In contrast, if the patient has covered the deductible and has Medicare Supplement Health Insurance (Medigap) that covers coinsurance (as I do), there is no incentive to shop since the patient captures none of the savings.

There is an extra benefit from price transparency: If shopping for shoppable services by some consumers pressures originally high-priced sellers to cut their prices, the disappearance of the bad deals benefits all buyers, even ones that do not shop. In economics, if a sufficiently large proportion of consumers are shoppers, prices at which transactions occur can in theory converge on the competitive (lowest) price.

Whether drug price transparency rules actually lead to the outcome of shifts to lower-priced sellers and/or a fall in prices in the market has not yet been established empirically. Some state experiments with legislative transparency have failed to lower prices relative to other similar states that did not enact such rules. Legislated price transparency alone in populations with generous health insurance coverage does not lower costs. People who are newly enrolled in high-deductible plans do not move to lower-priced sellers; they just use less care in general. High-deductible health plans, intended to make consumers price-sensitive, but with no effort to inform consumers about prices, also do not lower costs. The combination of high deductibles and price information has not been tested on a large scale, much less at a market level, so the evidence for cost containment effectiveness is incomplete. Still, the plausibility of the argument about what seems like a good idea has had bipartisan appeal. The most recent manifestation of that appeal is a proposed act now before Congress called the Lower Costs, More Transparency Act.

Strangely, one major part of the act does not envision that buyers’ searches will cause them to converge on the lowest price. Instead, it proposes a requirement that prices paid by Medicare for Part B drugs be “site-neutral” between hospital outpatient departments and physician’s office practices, meaning that the same drug is reimbursed at the same price regardless of the kind of firm providing it. This combination reflects a logical inconsistency that is bound to erode support for the act. Indeed, this provision, and other similar proposals for site-neutral payments for other medical services, has been vigorously opposed by hospitals which often charge and receive (from Medicare fee-for-service [FFS] and Medicare Advantage [MA] plans) higher prices for many outpatient services than physician’s offices. One advocate of this provision argued that the “implementation of site-neutral payment represents the triumph of transparency.” This is a surprising statement since legislation compelling the results of the Law of One Price in a setting that differs from the competitive ideal is in effect an abandonment of the idea that buyers can search effectively when price variation is transparent.

What is going on here? As noted above, the presence and form of Medicare Part B coverage attenuates patient incentives to seek lower prices for a Part B drug injection or infusion and may eliminate it altogether. Instead, if there were a large Part B deductible and price transparency across all providers in a market, site-neutral payments would emerge as if by an invisible hand because patients would move to physician’s offices and away from hospital departments. There would be no need for changes in insurer reimbursement rules for services above the deductible. There are MA options in some states in which the MA insurer uses its money from Medicare to make a deposit toward a tax-free, rollover Medical Savings Account (MSA) coupled with a High-deductible Health Plan (HDHP). Right now these plans are not very common, although some commentators speculate that the familiarity and satisfaction with Health Savings Account (HSA) and HDHP combinations in conventional insurance may make consumers eager to choose them when they go on Medicare. It hasn’t happened yet, so a larger number of consumers shopping for low-priced physician’s office care in preference to high-priced hospital outpatient care has not been large enough to put pressure on the latter. Moreover, as long as Medicare pays more to those high-priced sites of care for the great bulk of enrollees, the sites can use the funding to make their option more attractive—even to those paying the full price differential, as well as those with coinsurance paying part of the differential.

Persons with high-risk conditions would not generally choose MSA plans, but if they did, they probably would exceed the deductible and therefore not have to go price shopping. Compared to across-the-board site neutrality in FFS Medicare, this alternative would offer much stronger incentives to beneficiary-consumers to take relative benefits and prices into account, without the need for FFS and Medicare insurers to fix the prices paid to different sellers. It would be much less in price fixing spirit and much more in the market functioning approach to help Medicare cope with its financial challenges.

In particular, if advocates of the HSA/HDHP approach to health care financing had the courage of their convictions, they should be looking for legislation to make the combination more attractive in Medicare (for example, allowing beneficiaries to deposit their own funds into the account, or allowing plans to target the deductible to shoppable services). Doing so would be more logically consistent with the price transparency model and its supposed advantages than changing Medicare FFS payment policy.

Of course, a private insurer could now choose to offer plans that pay the same amount toward a given Part B drug regardless of site and then make the patient liable for any price higher than the payment rate, a type of reference pricing. The reward to the insured would be the anticipated lower premium. This would be better than just equalizing payments and giving no share of the gains to patients who move to lower-priced sellers.

Either approach would also address hospitals’ objections that their versions of these services are different from those in physician’s offices in ways that improve quality and adjust to patient illness severity, even as they entail higher costs. If this claim is correct, sicker patients or those impressed by higher quality or stand-by facilities will continue to patronize hospitals (and pay the extra fees) so there will be no financial harm to hospitals or diminution of access to care (whose additional quality is worth the additional cost). As usual, very low-income dually eligible Medicare beneficiaries should not have to participate in these financial experiments—until evidence on their outcomes is established.

In effect, the site-neutral part of the proposed act goes straight to the Law of One Price outcome; without the need for buyer choice, price transparency is discarded. Is this a good idea? If we were certain what that one (reimbursement) price would be that would assure adequate access to care of adequate quality, the provision would make sense. Unfortunately, there is presently not enough evidence to set the “right” one price so there will be adverse effects if it is set too low (inferior access and quality) or too high (excess payments to providers). In contrast, the model of price transparency, patient choice, and high deductible insurance will, in theory, lead to an outcome in which the provider distribution of prices will be ideal (truly high quality or more satisfactory providers for sicker people charging more) as will the distribution of patients across those providers.

Logical consistency in legislative outcomes may be too much to expect of the collective choice process, though consistency within a single bill would be more likely. The current absence of evidence on why patients with some characteristics that affect cost (like illness severity) or access (like minority status) makes it hard to set up a template for ideal rules leading to an ideal outcome. Trial and error—pass the act and back off if bad outcomes ensue—may be the best we can expect. But a more careful conceptual analysis and the provision of key missing information might help.

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Research Brief: Shorter Stays in Skilled Nursing Facilities and Less Home Health Didn’t Lead to Worse Outcomes, Pointing to Opportunities for Traditional Medicare

How Threatened Reproductive Rights Pushed More Pennsylvanians Toward Sterilization

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

They Reduce Coverage, Not Costs, History Shows. Smarter Incentives Would Encourage the Private Sector

Research Brief: Less Than 1% of Clinical Practices Provide 80% of Outpatient Services for Dually Eligible Individuals