Acupuncture Could Fix America’s Chronic Pain Crisis–So Why Can’t Patients Get It?

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

In Their Own Words

We all agree that we should do what we can to ensure that children thrive. But legislators often lack the will to act on opportunities to do just that. Children from racial minority groups too often bear a higher burden from those failures to act. A proposed expansion of the Child Tax Credit (CTC) — recently passed by the House and now before the U.S. Senate — presents a golden opportunity to help lift children out of poverty and improve their health. Failure to act is not an option.

When the CTC was expanded as part of the American Rescue Plan Act of 2021, child poverty in the United States had the greatest reduction ever recorded, falling nearly in half (9.7% to 5.2%). After the expansion expired in January 2022, child poverty spiked by 41%. Black and Latino children had the greatest increase in poverty.

A bipartisan group in Congress is working to bring some relief to those children living in poverty. Their proposal specifically prioritizes children who are currently left out of the credit because their families’ incomes are too low to qualify. The expansion would also make any family working full-time at the federal minimum wage eligible for the maximum refundable credit amount – $1,800 for one child, $3,600 for two children, and $5,400 for three children. The change is estimated to lift 400,000 children above the poverty line in just the first three years!

You might expect an economist to write about the impact of this bill, but you may be thinking, “Why a pediatrician?” The downstream effects of poverty make this bill a health fairness issue. There are undeniable links between race, finances, and health. In the United States, there is a significant racial and ethnic disparity in wealth. On average, Black and Hispanic families have 30% of the wealth of white families. These disparities start early on and persist throughout life. Specifically, children bear the most long-term impacts of poverty. Disparities in wealth have concrete effects on wellness. Compared to those who are wealthier, those with lower wealth have lower life expectancy, lower self- reported health, and increased rates of smoking, asthma, obesity, and hypertension. Physical wellness translates into mental and emotional wellness, as lower wealth impacts stress and anxiety.

Income supports and tax credits like the CTC are tools we can use to improve health outcomes.

As part of the Medical Financial Partnership at Children’s Hospital of Philadelphia (CHOP) — an antipoverty initiative — we see the impacts of such financial supports on patients and families first-hand. As one mom who took advantage of our West Philadelphia clinic-based tax preparation services said: “Becoming an employed mom, it is believed that you will be able to take care of the financial needs of your children. However, with the cost of living constantly rising, it becomes challenging to keep sustaining such a life. The child tax credit helps with that sustainability. Last year, I was able to buy clothes and shoes for my two sons- something that I am unable to do regularly due to having to choose between food, shelter, and clothing. The extra money helped to provide basic needs that my paycheck could not cover. Needs that my children shouldn’t have to live without.”

Health declines occur when basic needs aren’t met. Long-term consequences of poor wealth and health reinforce the cyclical nature of poverty. We already have evidence that an expanded Child Tax Credit lifts children out of poverty and promotes health. Millions of children suffered at the hands of Congress after they did not extend the expanded CTC. This bill does not represent the end-all-be-all of interventions. The tax credit passed by the House is roughly half of the credit provided during the pandemic. But it is an opportunity for Congress to begin to make amends.

Don’t let partisanship destroy what would improve the lives of many poor children. Reach out to your senator today. Let them know that you support helping low-income families; that you care about children thriving (especially our Black and Brown children more affected by poverty); and that failure to act is not an option.

Together, we can move a little closer to making child health a reality for more children.

The op-ed above first appeared in PennLive on February 7th, 2024.

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

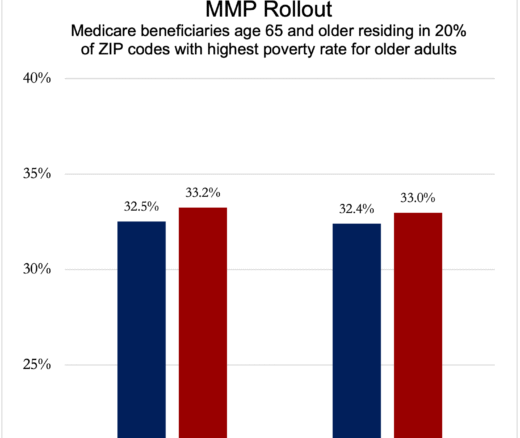

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Research Brief: Shorter Stays in Skilled Nursing Facilities and Less Home Health Didn’t Lead to Worse Outcomes, Pointing to Opportunities for Traditional Medicare

How Threatened Reproductive Rights Pushed More Pennsylvanians Toward Sterilization

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

They Reduce Coverage, Not Costs, History Shows. Smarter Incentives Would Encourage the Private Sector