Acupuncture Could Fix America’s Chronic Pain Crisis–So Why Can’t Patients Get It?

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

Blog Post

The growth of private equity investment in health care is facing sharp scrutiny from investors, regulators, and the public. Some view private equity as a key to transforming the U.S. health system. Others raise concerns that profits for corporate investors will be at the expense of patients’ health, workers’ safety, and affordability. LDI Senior Fellows Mark V. Pauly and Lawton Robert Burns argue that we have seen this movie before. Looking at past private equity purchases will help us understand the future.

In their study, published in the Journal of Health Politics, Policy, and Law, they identify two historical waves of private equity investment in physician practices—in the 1990s and from the passage of the Affordable Care Act in 2010 to the present. They then assess the similarities between the investment goals of each wave—shown in the table above. Pauly and Burns say that strategies across private equity investment have largely stayed consistent. However, the investigators say there’s “less public information on firm performance” today. So, they argue, the current “brouhaha” should be tempered by past experience.

The study, “Equity Investment in Physician Practices: What’s All This Brouhaha?,” was published on February 7, 2024 in the Journal of Health Politics, Policy, and Law. Authors include Mark V. Pauly and Lawton Robert Burns.

A Proven, Low-Risk Treatment Is Backed by Major Studies and Patient Demand, Yet Medicare and Insurers Still Make It Hard To Use

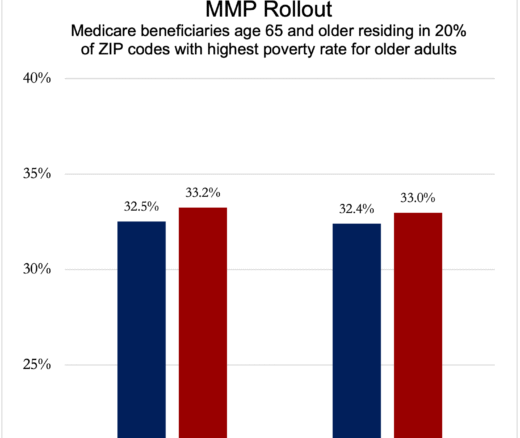

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Research Brief: Shorter Stays in Skilled Nursing Facilities and Less Home Health Didn’t Lead to Worse Outcomes, Pointing to Opportunities for Traditional Medicare

How Threatened Reproductive Rights Pushed More Pennsylvanians Toward Sterilization

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

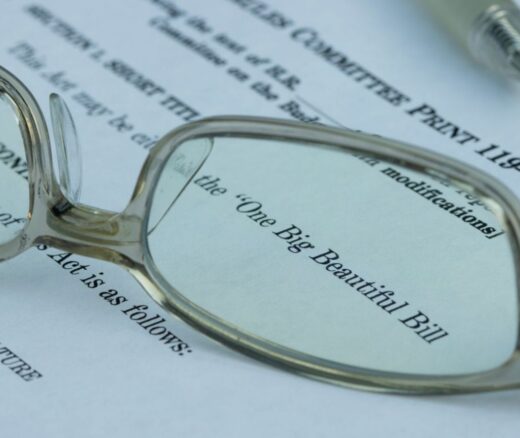

They Reduce Coverage, Not Costs, History Shows. Smarter Incentives Would Encourage the Private Sector