Parents Need Time, Not Deadlines, After Fetal Diagnoses

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

Blog Post

When he considers all elements of the Inflation Reduction Act (IRA), Alex Olssen doesn’t mince words.

The act represents the first major legislation in U.S. history “with an explicit focus” on setting drug prices, said Olssen, a senior fellow at the Leonard Davis Institute of Health Economics, the hub of health policy research for the University of Pennsylvania.

Under the IRA, the federal government will negotiate Medicare prices for high-priced drugs in Part B for physicians and in Part D for patients, said Olssen, who is also an assistant professor of Health Care Management at The Wharton School.

He wonders how deftly the government will set prices and whether they will be so low as to harm innovation.

The measure will also alter Medicare Part D insurers’ ability to differentiate their plans and limit patient cost sharing to $2,000 per year. Olssen supports that provision, but worries about unintended consequences.

The IRA “represents a big departure” from the government’s traditional noninterference in the Part D program, Olssen said. Drugs with negotiated prices must be covered on all Part D plans – a change that will reduce plans’ differences over time and may erode the benefits of having insurers compete with one another.

As LDI prepares for its drug pricing conference on May 5, we sat down with Olssen to dig deeper into the implications of the IRA and gain some perspective from history.

Two things stand out to me in terms of the history of U.S. drug pricing legislation: first, the Hatch-Waxman Act 1984; second, the Medicare Modernization Act 2003. Hatch-Waxman provided the foundation for generic competition that is so important today. Generic substitution rates are very high and generic availability makes pharmaceutical markets highly competitive. Before Hatch-Waxman, the process for getting generic approval was arduous and generic utilization was low. Hatch-Waxman also recognized the importance of medical innovation and made important changes such as allowing pharmaceutical companies to recoup some exclusivity period lost for projects that take a long time to bring to market.

The Medicare Modernization Act established Part D, which started in 2006. Part D has experienced growing popularity, with more than 70% of beneficiaries signing up for the voluntary benefit. Part D substantially lowered beneficiaries’ annual drug costs, although out-of-pocket costs on the program are not capped. Part D has resulted in increased utilization of drugs among the elderly and has also increased incentives for medical innovation – particularly innovation targeted at the elderly.

Unlike Medicare for hospital services, where beneficiaries can either receive coverage from the government or from a private alternative, Part D coverage is only offered by private insurers. The government substantially subsidizes the program, but was originally prohibited from being involved in determining the prices that drug manufacturers receive in the program – the noninterference clause.

The Inflation Reduction Act (IRA) is the first major piece of legislation with an explicit focus on drug price regulation. In and of itself, that’s a big change.

I wonder if the cap in out-of-pocket prices might not turn out to be the most consequential part. Turning to the negotiations, I wonder how the government will determine the prices it wants for any given drug. Lower prices are not always better. We need to balance lost access to valuable treatments from high prices against the cost of dissuading medical innovation. There is a list of factors that the HHS Secretary will consider in negotiating prices, but it is still not clear how an appropriate balance will be found.

All Part D plans will be required to cover drugs that have negotiated prices. To the extent that negotiations target high-spending drugs, plans will be less differentiated in terms of coverage for high-spending drugs, and this will tend to undermine the point of letting private insurers provide plans in Part D. Moreover, as the government negotiates more and more prices over time, the concept of Part D leveraging competition to obtain desirable outcomes will be undermined.

Essentially, there will not be room for noncompliance. The one option drug manufacturers will have: no coverage on Medicare or Medicaid. However, given the way drugs will be chosen for negotiation, not having coverage on Medicare is likely to be a deal breaker. The HHS Secretary should be able to reduce prices for targeted drugs.

This is a big change. Insurance works by sharing risk and helping people who, unfortunately, face the worst situations. With risk aversion, downside risk matters the most; this is the rationale behind out-of-pocket maximums. Thus, I am a proponent of capping that spending in Part D. However, the details matter and the cap may have unintended consequences.

Currently, there is no out-of-pocket maximum in Part D. Instead, high spending beneficiaries reach a catastrophic phase (around $3,500 out-of-pocket) and pay 5% of drug costs thereafter. To reduce risk to insurers from enrolling many high spending beneficiaries, the government makes reinsurance payments to cover 80% of drug costs in the catastrophic region. Under the new law, patients’ out-of-pocket costs will be capped at $2,000. By 2025, beyond the cap, insurers will be responsible for 60% of costs (up from 15%) and reinsurance will only cover 20% of spending.

Thus, the law makes big changes in terms of who is responsible for the costs incurred in the catastrophic region. This matters because the number of beneficiaries reaching the catastrophic region has quadrupled since the program began. Now, Medicare payments for reinsurance account for almost one-in-two dollars of Part D payments – up from one-in-seven when the program began.

There will be no incentives for patients who reach the out-of-pocket max to choose cheaper drugs when they are available. This raises real concerns about moral hazard; patients who pay nothing at the margin may use expensive branded drugs even if they do not value them much more than cheaper alternatives. There is a tension between out-of-pocket caps and incentives to dissuade moral hazard, but creative solutions could be helpful here.

Plans will be responsible for the majority of spending beyond the cap; and this will constitute an even larger share of spending than the catastrophic region currently accounts for. There will be strong incentives for plans to be more restrictive about utilization – either through formulary placement or through utilization management (although plans will not be able to exclude high-spending drugs with negotiated prices).

High-priced drugs that get on formulary may see increases in sales because patients will be completely shielded from costs. If this happens, the out-of-pocket cap may even increase incentives for medical innovation (just as Part D itself increased incentives for medical innovation by providing more elderly with prescription drug insurance).

How will the budget implications of this all shake out? Plan costs look set to increase substantially. One concern for beneficiaries is that premiums will increase as a consequence. However, along with out-of-pocket caps, premium increases will be capped at 6% a year.

If out-of-pocket caps result in increased spending on high-priced drugs, then someone must pay for that spending. It’s not beneficiaries, and the government’s responsibility for over-the-cap spending will be 20% relative to the 80% it currently pays for catastrophic spending. With premiums capped, what will give?

Abortion Restrictions Can Backfire, Pushing Families to End Pregnancies

They Reduce Coverage, Not Costs, History Shows. Smarter Incentives Would Encourage the Private Sector

Research Brief: Less Than 1% of Clinical Practices Provide 80% of Outpatient Services for Dually Eligible Individuals

New Findings Highlight the Value of 12-Month Eligibility in Reducing Care Gaps and Paperwork Burdens

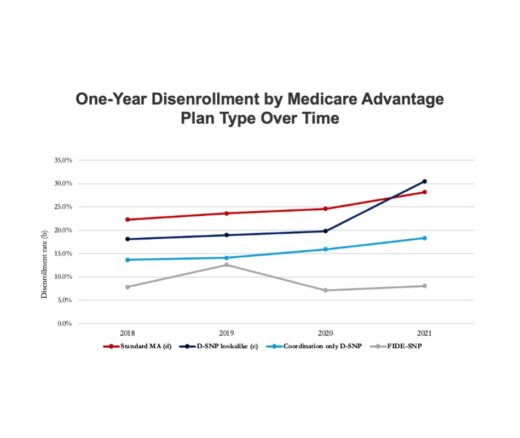

Chart of the Day: Fully Integrated D-SNPs Kept These Vulnerable Patients Enrolled, a New Study Finds

Democrats Must Go Beyond Reversing Trump-Era Cuts With a New Strategy to Streamline Coverage, Reduce Waste, and Expand Access to Medicaid