When Medicare Sent Patients Home Sooner, Mary Naylor Built the Safety Net

Her Transitional Care Model Shows How Nurse-Led Care Can Keep Older Adults Out of the Hospital and Change Care Worldwide

In Their Own Words

Most Americans who are not poor, elderly, or disabled have private health insurance. About 85% of them get coverage in connection with their job, and most of those plans are self-insured by employers who bear responsibility for the claims and choose what plans are offered, including the network the plan will use and the cost-sharing incentives that steer workers to use network hospitals and doctors. Although there is some federal regulation of self-insured plans, employers have great discretion in what plans they offer, the permissiveness or restrictiveness of the plan’s features, and the broadness of the plan’s network of providers who contract to accept plan payments and cost-sharing.

Recently, health insurer provisions for paying physicians treating insured patients using out-of-network care have come under scrutiny. Two articles by Chris Hanby, published in the New York Times on April 7, 2024, brought the issue forward. The articles—“Insurers’ Lucrative Little Known Alliance,” and “In Battle over Health Care Costs, Private Equity Plays Both Sides,”—target high “balance bills,” when insured individuals use out-of-network doctors. The articles blame firms that administer those payments for stinting on reimbursements, a move that generates bonuses for them but high bills for insured patients.

Often the out-of-network providers are physicians who have found a plan’s in-network payments are not high enough for them to accept. Remaining out-of-network has the downside of higher copayment or coinsurance deterring business, but it has the upside of providers having an unlimited ability to balance bill the difference between their fees and what insurance pays (on top of any insurer-specified cost sharing).

The amount employers pay toward a given service rendered out-of-network can vary, as can the amount of help employers furnish to insured employees who are billed additionally by providers. As described in the New York Times articles, employers sometimes hire firms to determine this payment for services

Lower payments by insurers save insured workers money on average but at the cost of exposing patients to the financial risk of a higher balance bill. This means that reducing the allowed amount paid to out-of-network doctors will lower insurance premiums and reduce the attractiveness of out-of-network care.

For consumers (either employers or workers) choosing among health plans with different levels of allowed out-of-network amounts, the fundamental issue is their willingness to pay for more worker financial protection should the worker end up in a situation where it is difficult to use a network doctor—at the cost of higher insurance premiums and higher average out-of-pocket payments to employer and worker.

Hence, insurance buyers face a tradeoff between high and low insurance allowances for out-of-network care—high payments raise total average spending and spending per unit but reduce financial exposure to high balanced billed amounts. There is no ideal or fair level of allowance; it all depends on what the buyer (not the insurance administrator or their agent) wants to have happen.

The “No Surprises” Act forced some limits on balance billed payments for emergency services. Price transparency laws at the federal and state levels can require advance notice of additional billing. Nevertheless, according to the Times’ stories, some people who use out-of-network care receive high bills because their insurance pay the provider a relatively low amount.

The fundamental relationship between payment and charges for out-of-network care is one of bargaining between insurance buyer and provider; the risk of an unexpectedly large bill can be avoided by using a network provider. The problem may result from imperfect information, since not all insured patients use the network, even for nonemergency services, and not all try to find out their level of coverage and potential for balance billing in advance

The reimbursement level for out-of-network providers in most insurances with networks is usually close to the allowance for in-network providers (with incentives to choose them relying on patient cost sharing). It is almost always much higher than what Medicaid would pay and also often several multiples of Medicare fee-for-service payments. No fundamental economic principle determines what this payment rate should be nor how much in excess of it a provider might charge. Likewise, no fundamental principle determines the provider’s total charge or the decision to balance bill. Presumably, some average or modal (or 90th percentile) charge level for privately insureds could represent the “market rate” within a local area, but a given provider might sometimes charge more. If providers (or the hospital where they practice) develop a reputation for continually sending high balance bills, demand for both hospital and physician services may fall—but there is no evidence that this happens. The insurance or consulting company that administers self-insured benefits can therefore set any amount within reason; and employers, on behalf of their workers, can choose how to trade higher claims costs and higher premiums or lower wages for more generous payments to providers and less financial risk for insureds.

Some employers have contracted out the task of setting up networks and determining payment levels to separate administrative firms. Employers have to be careful here: they want to reward sharp bargaining, but they do not want to overpay for setting lower payments, especially if those lower payments foist higher balance bills on their workers. Agreeing to overpay a bargaining agent does happen, but is sloppy contracting by the employer, not illegal behavior by the agent.

In the case of health provider payment, agents that bargain with out-of-network doctors increasingly use (secret) algorithms to set the amount. Administrators may be incentivized to bargain hard if their commission is based on how low they can go with the provider and still get an acceptable payment. What should matter to the employer is its final claims cost and expected out-of-pocket payment, not whether the administrator can report back a low allowed amount. Moreover, the cost should be compared to using some other competitive agent—not to some hypothetical counterfactual proposed by the bargaining agent.

Critics have singled out MultiPlan, claiming the agency harms doctors by using secret algorithms to set low allowances, and then harms consumers who receive larger balance bills. This approach has, in the past, allowed MultiPlan to make millions, but it has also lost millions; it is presently traded on the NYSE but about to be delisted because of a low share price and large losses.

In economics there are no evildoers, only bad incentives and lack of attention. Insurers or their agents will be harsh or generous depending on how much you pay them. But buyers need to beware: Employers should look at competitive opportunities and their prices when choosing who administers their benefits. Especially in a tight labor market, they cannot shift benefits costs to workers without making it up in higher wages—unless they overpay workers in the first place.

Some blame for big balance bills lies with administrators like hapless Multiplan, but much goes to employers, doctors, and even inattentive workers. And some balance billing is unavoidable because it is dictated by external circumstances. As in the rest of private health care, a good outcome requires both seller transparency and buyer attention.

Her Transitional Care Model Shows How Nurse-Led Care Can Keep Older Adults Out of the Hospital and Change Care Worldwide

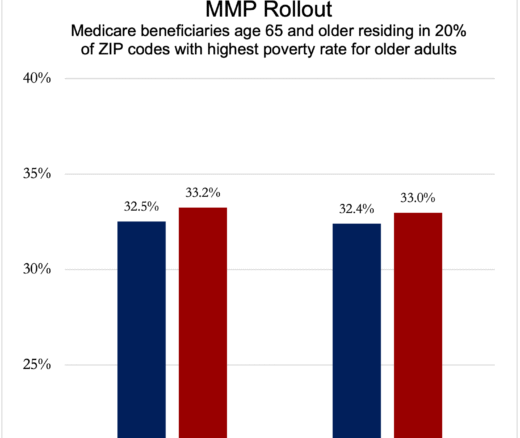

Chart of the Day: Medicare-Medicaid Plans—Created to Streamline Care for Dually Eligible Individuals—Failed to Increase Medicaid Participation in High-Poverty Communities

Penn LDI Debates the Pros and Cons of Payment Reform

One of the Authors, Penn’s Kevin B. Johnson, Explains the Principles It Sets Out

Six Lessons the U.S. Can Learn from Europe About Protecting Health Data Linkages

Moving from Fee-for-Service to Risk-Based Contracts Hasn’t Dramatically Changed Patient Care, Raising Questions About How to Make These Models More Effective